Uncertainty surrounding the future of oil and gas has been steadily intensifying, with President Biden cancelling Keystone XL and BlackRock pressing companies to show how they align with a net zero future. And as Canada works toward achieving net zero emissions (alongside major global economies like the United States and China), how is the outlook for oil production in this country changing? Our recent report, Canada’s Net Zero Future, provides insights.

The future of oil production in a net zero world

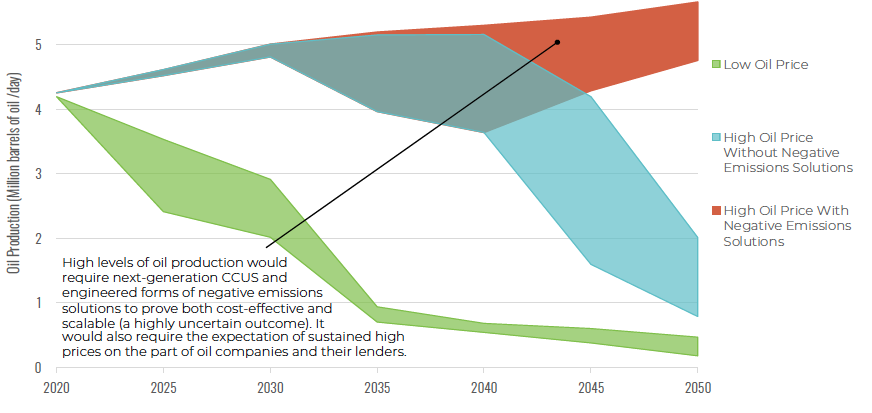

In our analysis of more than 60 net zero scenarios for Canada, three distinct paths for Canadian oil production emerge (see Figure 1):

1) production declines significantly over time;

2) current production levels are sustained, or even grow, over the long term; or

3) production continues or grows in the medium term, followed by a rapid decline.

Which path Canada ultimately follows will depend on a range of factors. Internal policy choices will influence some of those factors. But the major driving forces are outside Canada’s control—or Alberta’s, Saskatchewan’s, or Newfoundland and Labrador’s, for that matter.

Figure 1: Canadian oil production under low and high global price scenarios for oil across pathways to net zero

Path #1 (green): Production declines significantly over time

One of the most important factors shaping Canada’s net zero future is the global price of oil. If Canada’s net zero transition occurs alongside accelerating global climate action, oil demand—and oil prices—could dramatically decline. In our low oil price scenarios, benchmark global oil prices decline to US$38 a barrel by 2030. They drop slightly further to US$36 by 2050 (based on the Canadian Energy Regulator’s 2018 Energy Futures). Our projections suggest that, under these conditions, Canadian oil production would decline steadily over the next 30 years.

Factors that Canadian firms and Canadian policy choices can influence don’t substantially alter this result. Deeper cuts in the emissions intensity of Canadian oil sands production would not substantially change this course. Many existing oil sands facilities—given low marginal costs of production—could continue to produce for several years. But new investment would dramatically decline.

Path #2 (red): Production continues, or even grows, over the long term

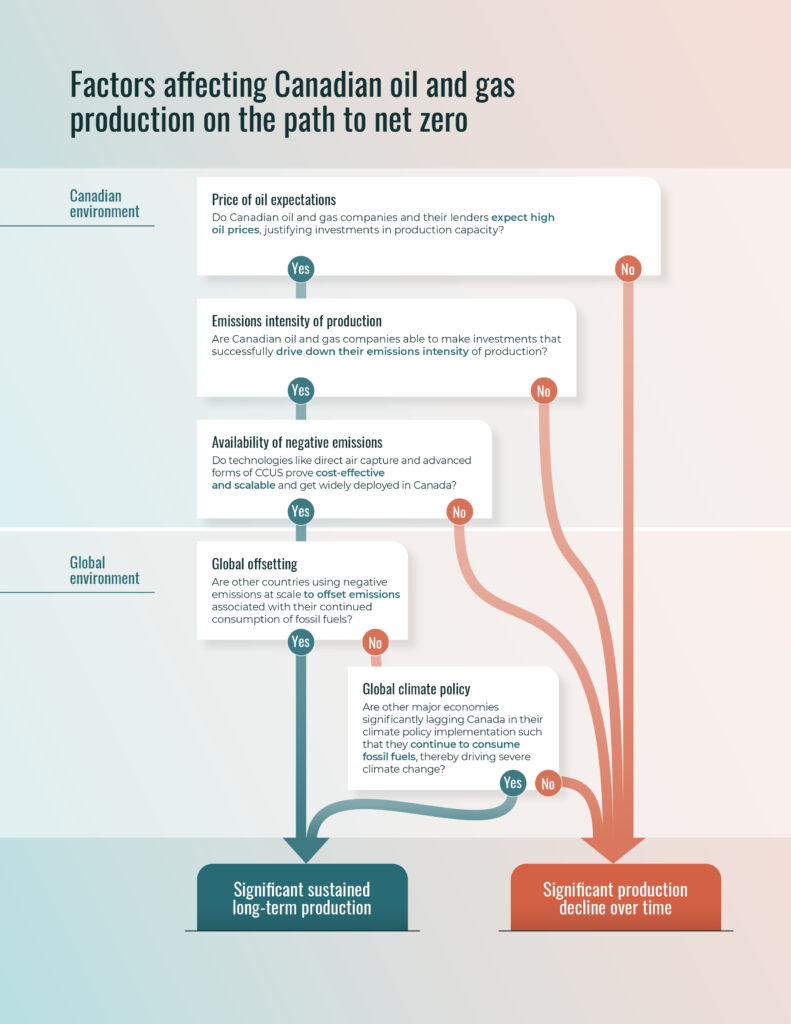

On the other hand, our analysis finds that Canadian oil production levels could stay steady or even grow on the path to net zero. But that would be only if four very specific conditions come to pass (see Figure 2).

- First, the global price of oil would have to rise above current levels and remain high. High oil price scenarios in our analysis have benchmark global prices rising to US$63 a barrel by 2030 and US$87 a barrel by 2050. This would require either weak global climate policy or widespread global adoption of negative emissions technologies (discussed below).

- Second, oil companies and their lenders would have to have the expectation of sustained high oil prices, in order to justify continued investment to maintain or grow production capacity.

- Third, oil companies would have to make significant investments to further reduce the emissions intensity of their production to remain competitive.

- And fourth, demonstration-stage negative emissions technologies (such as direct air capture and advanced forms of carbon capture utilization and storage) would have to prove cost-effective and scalable. They would have to be deployed at scale in Canada. Beyond uncertain technological development, the widespread deployment of these technologies would face significant barriers. They include, but are not limited to, unprecedented infrastructure build-out, the establishment of a global greenhouse gas accounting and trading system, access to sufficient capital and overcoming public opposition.

Given these essential conditions, betting on this future is risky. What happens if those highly uncertain demonstration-stage technologies don’t pan out? That brings us to the third path.

Figure 2: Oil and gas production in Canada

Path #3 (blue): Production continues or grows in the medium-term, followed by a rapid decline

With sustained high oil prices, Canada may see continued demand for its oil products in the medium term. But without the successful commercialization and extensive deployment of negative emissions technologies, our analysis shows that production levels would begin to decline rapidly in the next 10 to 20 years—high prices or not.

Continuing to bet on a future that assumes high oil production risks locking-in emissions-intensive industries, infrastructure, and technologies (while locking-out lower-emissions alternatives). These choices result in “stranded assets,” with significant investments becoming uneconomic. It also risks putting off critical economic diversification in regions whose economies are closely tied to oil production. The vulnerability of Canada’s oil sector to forces beyond our control underscores the importance of having an eye to the future and ensuring that workers and communities have access to supports so that they aren’t left behind.

Betting on an uncertain future

Our analysis concludes that sustained oil production in Canada faces a precarious future. The outlook for natural gas production in Canada is similar. And while it’s possible achieving net zero in Canada could be consistent with a thriving oil sector in the long term, counting on this outcome makes for tricky risk management given the significant drivers outside of Canada’s control.

On one hand, negative emissions technologies such as direct air capture represent the tempting prospect of a silver bullet. And the benefits of big technological breakthroughs would be significant, both for Canada’s oil and gas regions as well as global efforts to reduce greenhouse gas emissions. At the same time, downplaying the risks of betting on sustained, long-term oil production could put workers and communities whose livelihoods rely on this sector at greater risk of economic turmoil and job loss. It could also make meeting our climate targets harder if we put all our hopes in a future technological breakthrough.

But there are ways to navigate that risk and uncertainty. A net zero transition holds new potential for these regions as demand grows for hydrogen, biofuels, non-emitting electricity, or even developing negative emissions solutions. And many of these sectors require the resources, infrastructure, and skills found in oil-producing regions. The opportunities are there. The key is advancing them now so that workers, communities, and companies can find paths to prosperity in a changing world.