To stay competitive in the 21st century, a century that will be defined by rapid decarbonization and the rise of clean technology, Canada’s economy needs to find new sources of growth—and fast. Going after new opportunities is now the key to Canada’s future economic prosperity.

The billion-dollar question, however, is how to rapidly scale these opportunities up as the world rapidly decarbonizes.

More eggs, more baskets

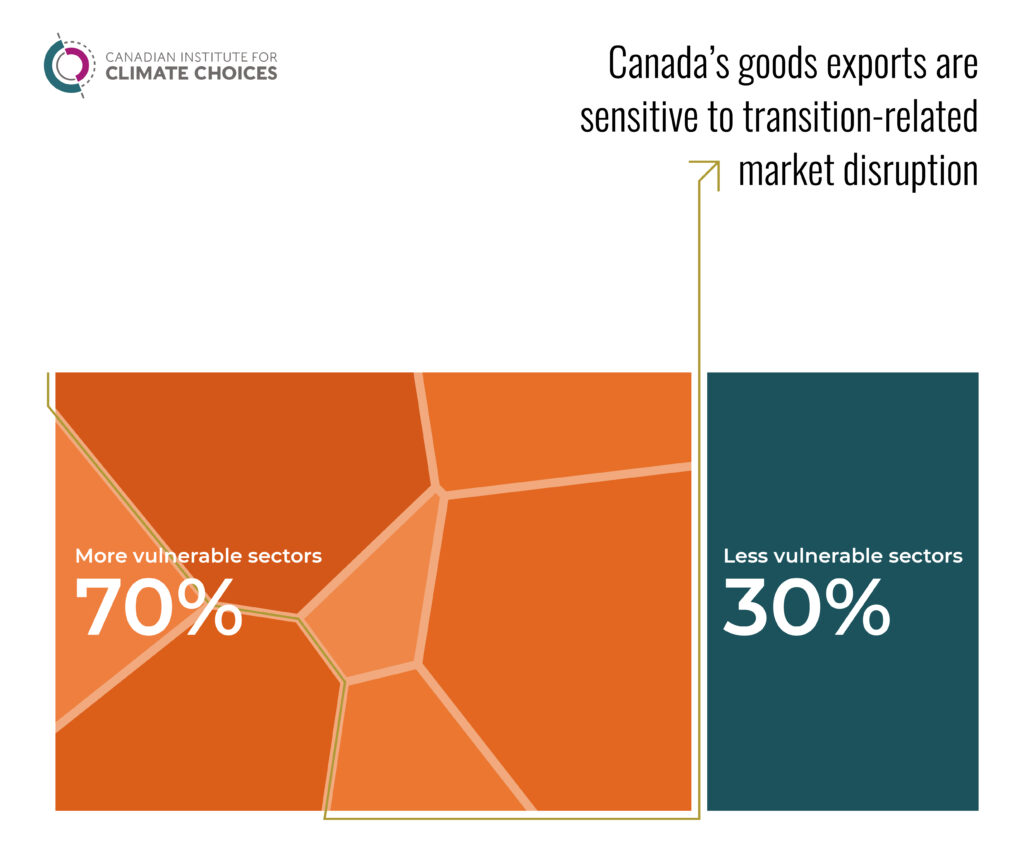

The global low-carbon transition will fundamentally transform world markets, jeopardizing Canada’s historical sources of economic prosperity. The Institute’s recent report Sink or Swim: Transforming Canada’s economy for a global low-carbon future finds that nearly 70 per cent of the country’s goods exports could face significant disruption as global demand and trade patterns respond to an acceleration of climate policy, technological advancements, and climate-conscious capital markets. This global low-carbon wave, our report finds, is already rising, and represents a sink-or-swim moment for Canada’s economy.

The good news, though, is that as global markets shift, Canada stands well positioned to lead the development of new sources of explosive growth. In some cases, this means growing investment and companies in new markets (for example, alternative proteins, clean hydrogen, electric vehicle battery recycling, and grid-scale energy storage). In others, it means using new technologies to help transition and transform incumbent industries to align with the global low-carbon transition (for example, electrifying buildings and transport, or using advanced technology and software to make mining and agriculture more efficient, precise, and less emissions-intensive). But in either case, these emerging opportunities are the key to Canada learning to swim.

Bet on transition

The Sink or Swim report took a deep look into what these future opportunities could look like at a global level and, from there, where Canada might have competitive strengths. We use company-level data from PitchBook Data Inc. to better understand investment trends and compare these data to market and scenario analyses looking at growth potential in a low-carbon future. The global market for plant-based proteins, for example, could grow 10-fold to $140 billion by 2029, while clean hydrogen could create $2.5 to $12 trillion in market opportunities by 2050 (compared to its tiny market today).

In total, we identify nine transition-opportunity markets where Canadian companies already have a foothold, each with at least 10 companies active and successfully attracting investment.

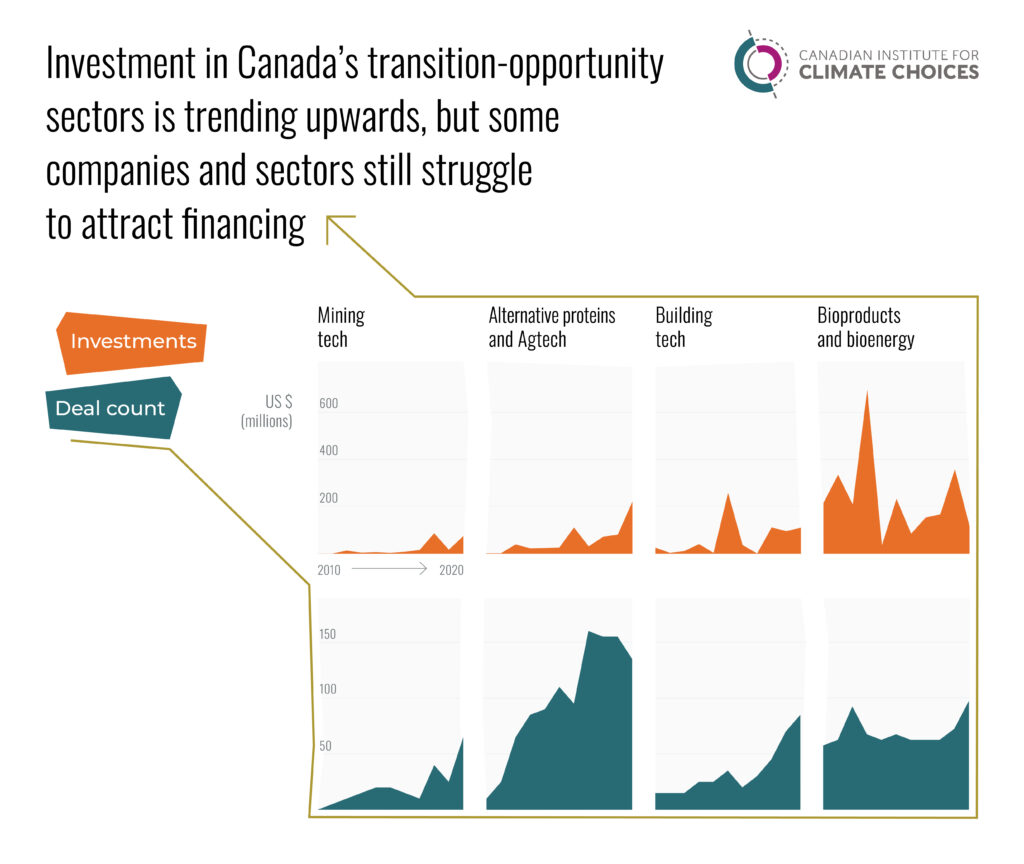

The figure below shows investment trends across these different markets over the past decade: agtech and alternative proteins, batteries and storage, bioproducts and bioenergy, building tech, carbon capture and utilization and storage (CCUS), clean hydrogen, low-carbon electricity, low-carbon transportation, and mining tech. Across the companies in these nine markets, investment more than quadrupled between 2010 and 2020 and the total number of business deals (i.e., investment transactions) more than tripled. Detailed profiles of each transition-opportunity market are on our website, here.

Right slope, wrong scale

The growth of new capital into these transition-opportunity sectors is promising, but it’s small fry relative to the entire economy. Total investment in these nine areas between 2010 and 2020 was $11 billion, whereas total investment in Canada’s oil and gas sector over this same period, for example, was over $425 billion. Scaling up these opportunities to a level that makes a meaningful contribution to local and national economies requires significantly more investment.

At the same time, capital flows are uneven across the nine sectors. The big investments are mostly flowing toward mature, safe-bet technologies, such as low-carbon electricity (wind, solar), low-carbon transportation (electric vehicles, micro mobility), and bioproducts and bioenergy (first generation biofuels). Investments have lagged in less mature, wild card technologies—those technologies that have either not reached significant commercialization yet, or where future market demand is unclear. These include markets such as clean hydrogen, carbon capture, building tech, batteries and storage, agtech and alternative proteins, and mining tech.

Critically, the benefits to scaling up these markets transcend the profitability of individual companies. Let’s unpack what that means.

Early technology adoption or first-of-their-kind projects can have huge societal benefits. Adopting new technologies can spark a positive feedback loop where lessons learned improve the technology and reduce costs. Better and cheaper technology then encourages greater demand and, in turn, helps lowers costs even further, triggering more learning and higher demand. The costs associated with solar power, for example, have declined by around 90 per cent over 10 years as the technology has expanded around the world. By using historical learning curves for other emerging technologies, there is good reason to believe that costs will continue to fall as deployment grows.

Unlocking uncertainty

So why, given these benefits, are investors slow to dip a toe in the water? In a word: uncertainty.

In many of these markets, investors and companies face a chicken-and-egg problem. Emerging products and services either aren’t widely available for consumers or remain too expensive, which creates low demand. In turn, this low demand discourages investors from getting into the market, which keeps prices high for consumers. The risk/reward ratio remains too high for investors as a result, preventing the scale of investment needed to commercialize technologies, build demand, and reduce costs.

These market uncertainties are exacerbated by policy uncertainty. Capital markets need assurances that Canadian governments will both implement and sustain the policies that are necessary to hit Canada’s long-term commitments and targets. These policies are what drive domestic demand for products and services aligned with the global transition. Whereas ambitious climate policies have long been viewed as a drag on Canadian competitiveness and growth, it’s now clear that the bigger risk is moving too slowly and missing opportunities.

The billion-dollar challenge is to rapidly accelerate investment and technology adoption rates in Canada. That way, companies can scale up domestically and export their technologies and knowledge abroad in growing markets. Too often, successful Canadian companies get snatched up by foreign competitors when it comes time to scale up. One measure of how far we have to go is that, right now, only around nine per cent of Canadian businesses are using clean technologies.

Learning to Swim

Canada is well positioned to benefit from the coming wave of global low-carbon transition. The nine transition-opportunities we explored offer promising growth and jobs that can help secure Canada’s long-term competitiveness.

Fully capturing these opportunities—and the societal benefits that flow from them—will not happen without significant and targeted government policy to address key uncertainties. To succeed, investors and companies in Canada need clear policy trajectories and enabling environments. Canada needs to learn how to swim in these choppy waters.

In reality, policy responses in Canada will need to be adapted to fit the local context. Different regions and provinces have different competitive strengths that require tailored approaches. Stay tuned for more in this area as the Institute takes a more detailed look at regionally and provincially specific policy solutions to capitalize on new growth opportunities in the global low-carbon transition.