The global low-carbon transition needed to avoid the worst impacts of climate change has already begun sweeping across economies and industries around the world, and it is building strength.

In response, Canada faces a critical choice that will define our economic prospects for generations: will we fight against the tide, simply tread water, or will we catch the wave and ride it to a prosperous, low-carbon future?

This report assesses the implications of this global transition for Canada’s economy, and the strategies that can be used to manage risks, seize opportunities, and drive clean, strong, and inclusive growth.

Scroll down to learn more.

A Thriving transition Is possible

To date, Canadian governments have not done enough to transform Canada’s economy to thrive in the years and decades ahead. There are enormous economic opportunities, but governments have tended to focus on minimizing near-term competitive risks rather than developing future competitive advantages.

How can Canada thrive? Our analysis finds that targeted government action can improve Canada’s chances of success by mobilizing private investment and smoothing workforce transition. The stakes are high: moving too slowly is now a greater competitive risk than moving too quickly.

Three big trends are transforming global markets

The global low-carbon transition is being accelerated by:

- international climate policy—countries representing more than 70 per cent of global GDP have committed to reach net zero emissions

- cheaper and better technology—wind, solar and electric vehicle battery costs have fallen by 60 to 90 per cent over the past decade—and

- a growing investor response—international investors with over 40 per cent of global assets under management have committed to supporting net zero goals.

The transition stakes are high for Canada, with over 70 per cent of our goods exports and over 60 per cent of foreign direct investment in sectors that are vulnerable to market disruption.

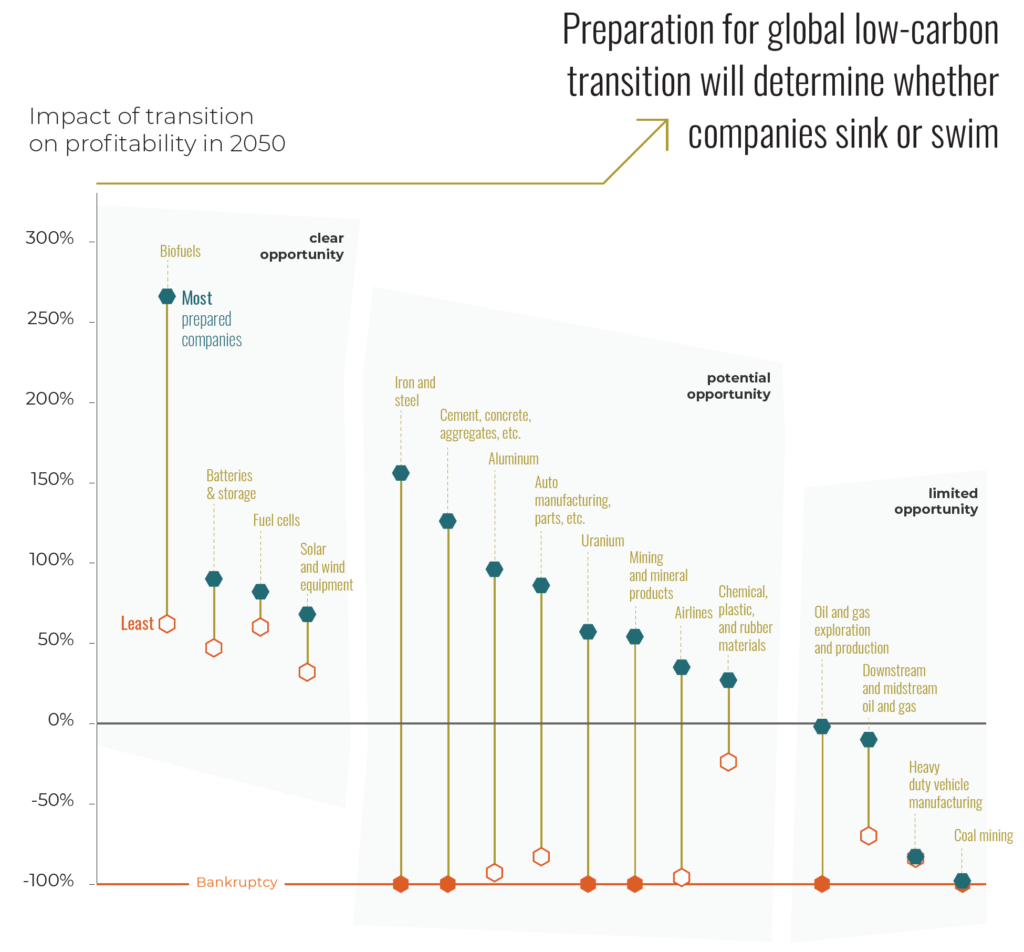

Which companies are transition-ready?

Companies in some sectors—like batteries and storage, or solar and wind equipment—will see higher profits through transition. Companies producing products such as coal and oil will see lower profits. Companies in several sectors could go either way, depending on the actions they take. For example, companies in steel, cement, and aluminium sectors could see higher profitability through transition if they dramatically lower emissions.

What are the drivers behind these changes?

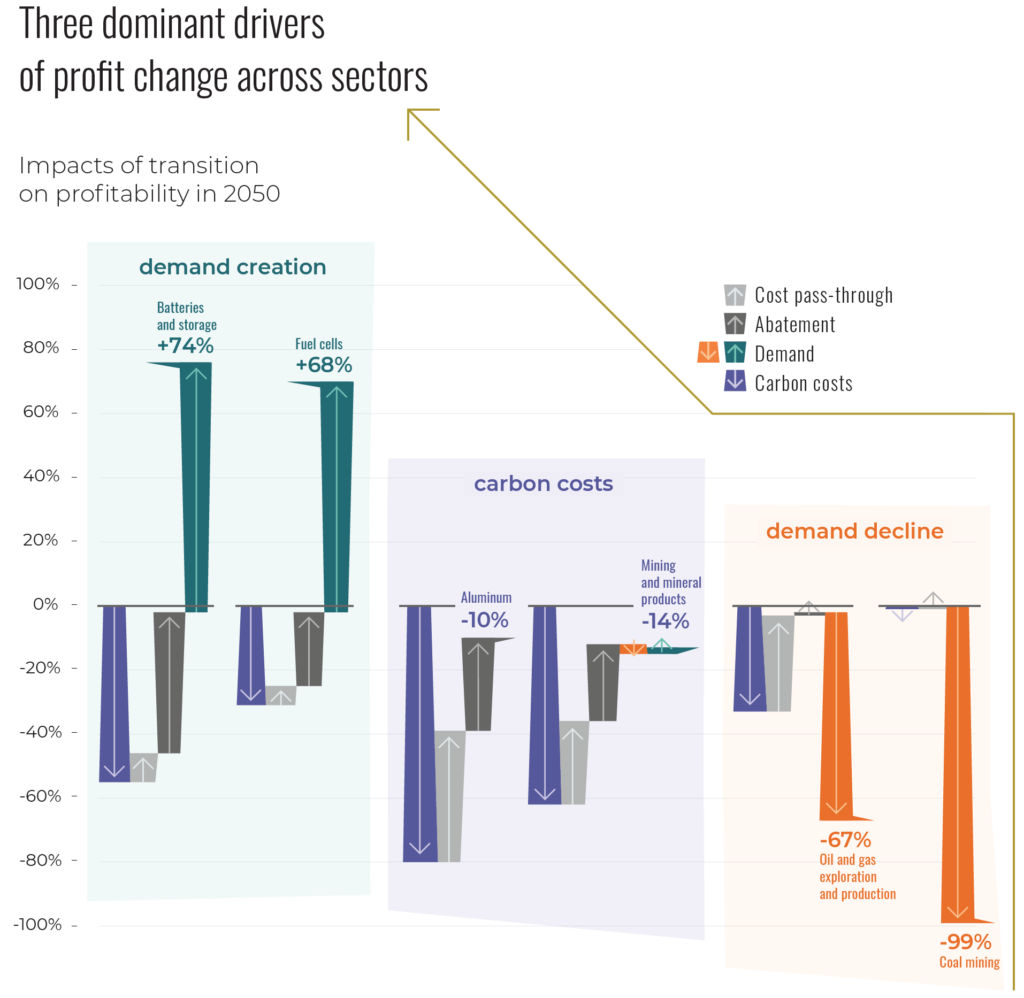

There are three main transition drivers that affect profitability:

- demand creation (growing global demand for the product), which increases profitability

- carbon costs (higher costs due to government policy and border measures), which decrease profitability and can be partially offset by abatement of emissions and passing costs through to customers

- demand decline (shrinking global demand for the product), which decreases profitability

The following graph illustrates these main drivers in six sectors:

How can Canada become more competitive through global transition?

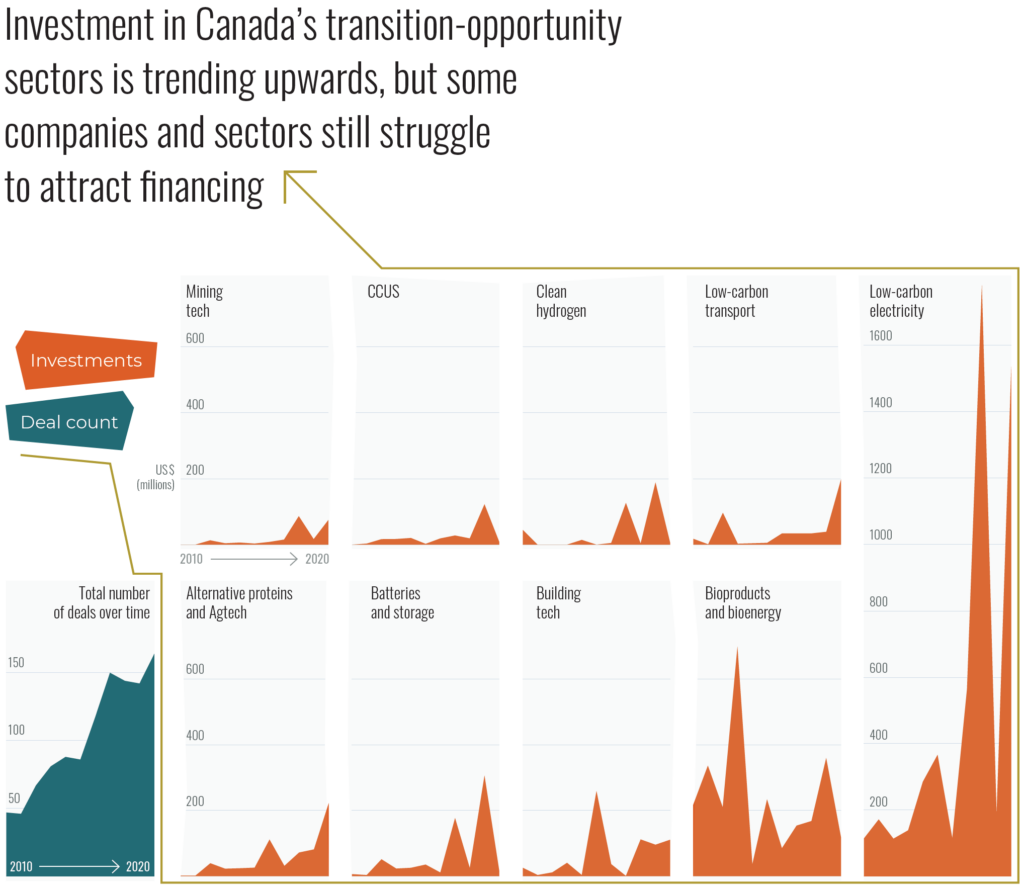

Canada needs more, and bigger, companies active in markets that will see growing demand through transition. There are hundreds of promising Canadian companies, but many still struggle to attract the investment they need to grow. Canada also needs transition-vulnerable companies to make the investments needed to thrive through global market change. For emissions-intensive manufacturing, that means reducing emissions intensity. For coal and oil, it means shifting into new business lines.

Dive deeper into transition-opportunity sectors

How will the low-carbon transition affect workers and communities?

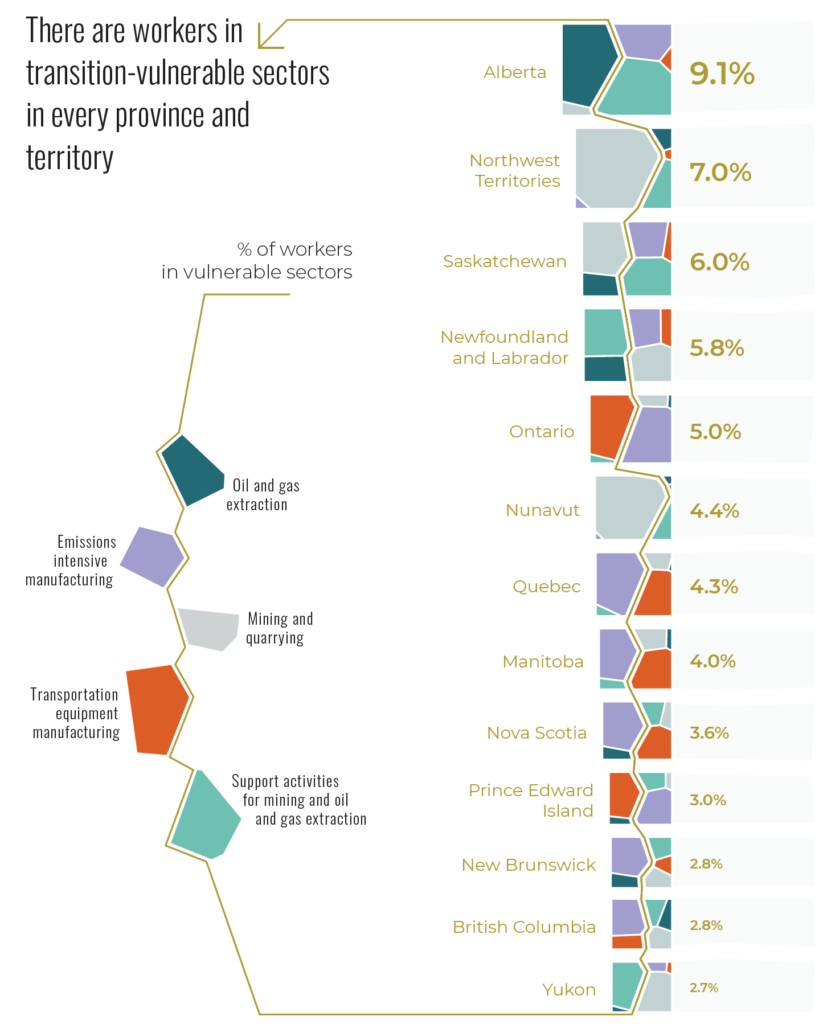

There are workers in transition-vulnerable sectors in every province and territory. Improving Canada’s transition readiness will help them maintain their jobs, or readily find new ones. By share of workforce, Alberta, the Northwest Territories, Saskatchewan, and Newfoundland and Labrador top the list. However, Ontario has the largest total number of workers due to its strong transportation equipment manufacturing sector.

There are many communities across Canada that have a relatively high proportion of workers in transition-vulnerable sectors. This graph shows communities with greater than 10,000 people that have more than 3 per cent employment in transition-vulnerable sectors. Some communities really stand out, like Wood Buffalo which has cumulatively 29 per cent of its employment in vulnerable sectors. These communities are vulnerable to broader impacts to service sectors and government tax revenues.

How do we ride the wave?

Governments have a major role to play in helping ensure strong economies in thriving communities. Our recommendations focus on four priorities for government action:

- Prioritize forward-looking decision making that considers the competitive benefits of climate action

- Emphasize future-fit innovation and economic development that supports growth in markets where global demand will be strong

- Develop local and people-focused transition plans that drive new areas of job creation, improve the resilience of the workforce and empower Indigenous economic leadership; and

- Mandate the disclosure of climate-related metrics that are decision-useful, building on international approaches to close gaps and mobilize private investment

These are the areas where government involvement is most needed to overcome market and non-market barriers to successfully navigate the low-carbon transition. Learn more in our report.

Download report

Dive Deeper: Transition-Opportunity Profiles

The following sectors all have great opportunities for Canada—if they can scale up fast enough to catch the wave.

A PROVINCE-BY-PROVINCE COMPARISON

Discover province-specific risks and opportunities, trends in transition-opportunity sectors, and barriers to accelerating progress in our provincial profiles.

NET ZERO OPPORTUNITIES

Indigenous Perspectives

To ensure our work reflects the diverse perspectives and issues facing Indigenous Peoples and Nations as the world transitions to a low-carbon economy, the Climate Institute commissioned a set of essays written by prominent Indigenous authors. The perspectives and insights within each essay fed directly into the analysis and findings of Sink or Swim.

Essay #1

Indigenomics: Our eyes on the land by Carol Anne Hilton

Essay #2

Our people have borne witness to climate change through deep time: Indigenous place-based people transitioning to a low-carbon economy by Frank Brown

Essay #3

Indigenous partnerships: the key to meeting Canada's climate commitments? by Tabatha Bull

STay Connected

Get the next report in this series

Sign up to receive future research from the Canadian Climate Institute, as well as timely policy analysis, blogs, and event invitations.